CMA CGM Joins France’s First Industrial Demonstrator Of Hydrogen And e-Methane’s Production

May 10, 2022

Whale Shark Population Plummeting Globally Due To Collisions With Ships

May 10, 2022

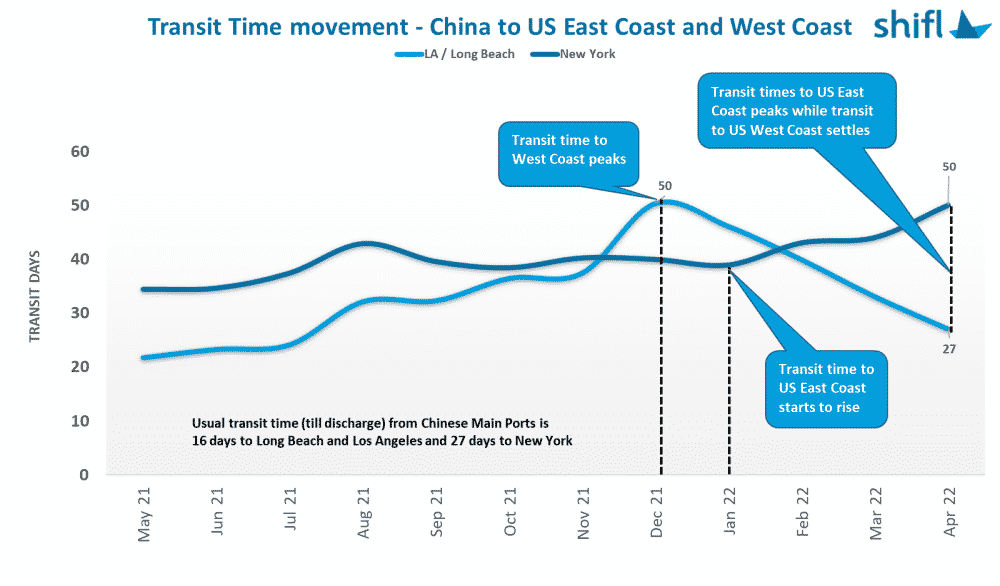

- Trans-Pacific transit times have fallen considerably across the US West Coast to 24 days from 54 days in Dec ‘21, while the US East Coast remains high for the same period

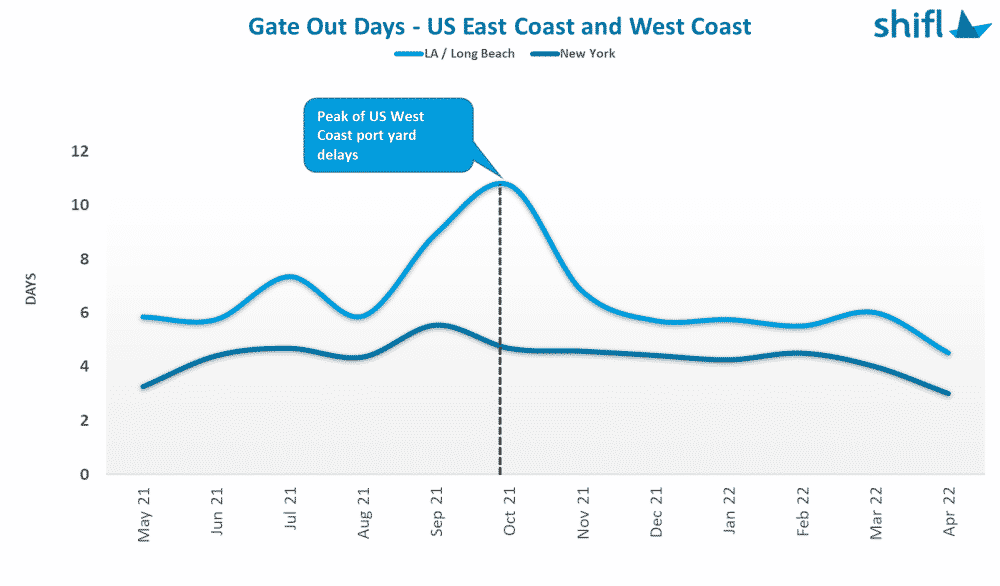

- Gate out times across the US West Coast and East Coast have shown significant improvement since the start of the year, trending lower at 5 days and 3 days respectively

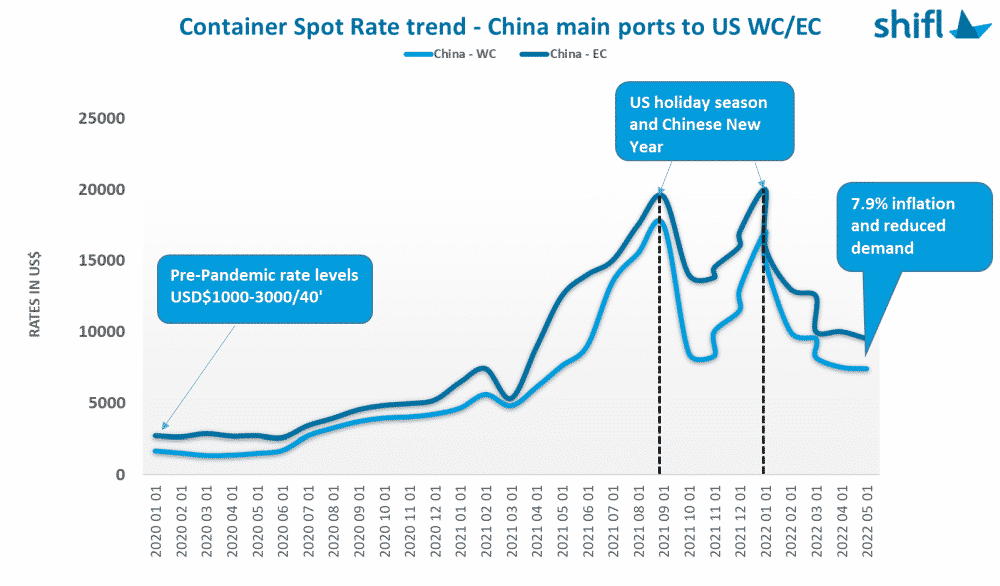

- Trans-pacific container spot rates that fell precipitously over this year set to continue its fall as carriers increase blank sailings in an attempt to contain the drop

Definitions

- Transit time = The time taken for containers from loading at Port of Load till discharge at Port of Discharge including waiting time at anchorage

- Container Gate Out = The time taken for import full containers from discharge till it is moved out of port

- Spot Freight rate = The freight rate charged by the carriers from port to port on a spot basis, (non-contract basis). We are only tracking 40’ container spot rates.

The US GDP fell 1.4% in the first quarter of 2022, which has concerned economists and analysts alike. Ripples have been felt across the Trans-Pacific corridor as discussions of a freight recession and cooling ocean freight spot rates hit the headlines.

The US saw an extremely high volume of imports in Q1 ‘22, increasing 4.77% from an already record-high Q4 ‘21 on the back of previous orders and consumer demand.

Meanwhile, the Chinese COVID-19 situation continues to worsen as movements within Shanghai remain restricted, shackling manufacturing output, trucking activity, and port throughput.

With Beijing teetering at the brink of a similar situation, the Chinese mainland might have problems returning to the previous smooth flow of cargo movement. This has been reflected in the cargo volumes from China sliding over May, and shippers believe the situation will remain murky for a while.

Transit times reduced drastically

The current drop in demand and the lockdowns in China helped the US West Coast ports recover from the port congestion and resulted in a drop in total transit time to the West Coast ports in April 2022.

The transit time from China to Los Angeles and Long Beach dropped by 85% from 50 days in Dec ‘21 to 27 days in Apr ‘22. Although it is a significant improvement, this is still above pre-pandemic levels.

At the peak of West Coast congestion, customers shifted deliveries of future orders to East Coast ports at the time when they were performing better. Those shipments are arriving now, and as a result, the congestion has shifted to the East Coast. Transit to the port of New York went up from 40 days to 50 days representing a 20% increase for the same period and an 85% increase from pre-pandemic levels.

“We however expect a relief in the East Coast congestion in the near future as the impact of blank sailings created by the decrease in demand and China lockdowns will be felt in New York, albeit little later than West Coast ports due to the naturally longer transit time,” said Shabsie Levy, Founder and CEO of Shifl.

There is however the unknown outcome of the labor negotiations talks between the International Longshore and Warehouse Union (ILWU) and marine terminal operators due to begin on the 12th of May 2022. There has been cause for concern in the market that any breakdown in negotiations may cause disruptions in the US West Coast operations and add to East Coast Congestion.

Container Gate Out times improve across both coasts

While the congestion outside the ports has shifted to the East Coast, the container gate-out times have been improving on both coasts. Los Angeles/Long Beach gate-out times improved by 28% dropping from 5.74 days in Jan ‘22 to 4.5 days in Apr ‘22 while New York had a 47% drop in container gate from 4.25 days in Jan ‘22 to 3 days in Apr ‘22.

Container spot rates are on their way down, down, and even more

The restrictions on truck movement and workers lowered China’s industrial activity with exporters having a hard time delivering export containers to Shanghai port. This has resulted in lower volumes flowing in the China-to-US trade lanes.

Container spot rates fell sharply on the back of the combined impact of reduced demand in the US and Chinese exports affected by the pandemic-induced shutdowns in Shanghai.

“The core reason for the continued drop in spot freight rates as we predicted previously is the reduced demand in the US which we are seeing from our customers’ data as well. The price of a 40’ container continued to drop in April 2022 to $7-8,000 for the China-US West Coast and around $9-10,000 for the China-US East Coast,” said Levy.

“Carriers have been trying to manage this drop in spot rates by implementing blank sailings while trying to lock shippers on longer-term contracts riding on the previous highs in hopes of extending their honeymoon period,” said Levy.

Disclaimer: The insights in this report are based on Shifl’s own freight data drawn from the significant volume of shipments handled by Shifl.

Press Release

Sharp Drop In Transit Times And US Spot Freight Rates As Demand Plummets: shifl appeared first on Marine Insight – The Maritime Industry Guide

Source: Maritime Shipping News