Seaspan Energy Completes First Ship-To-Ship LNG Bunkering In Canada

February 4, 2025

World’s 1st Fully Electric Offshore Vessel To Enter Operation In 2027

February 5, 2025

China responded immediately to the 10% tariff imposed by U.S. President Donald Trump on Chinese imports by announcing retaliatory tariffs and an antitrust investigation into Google.

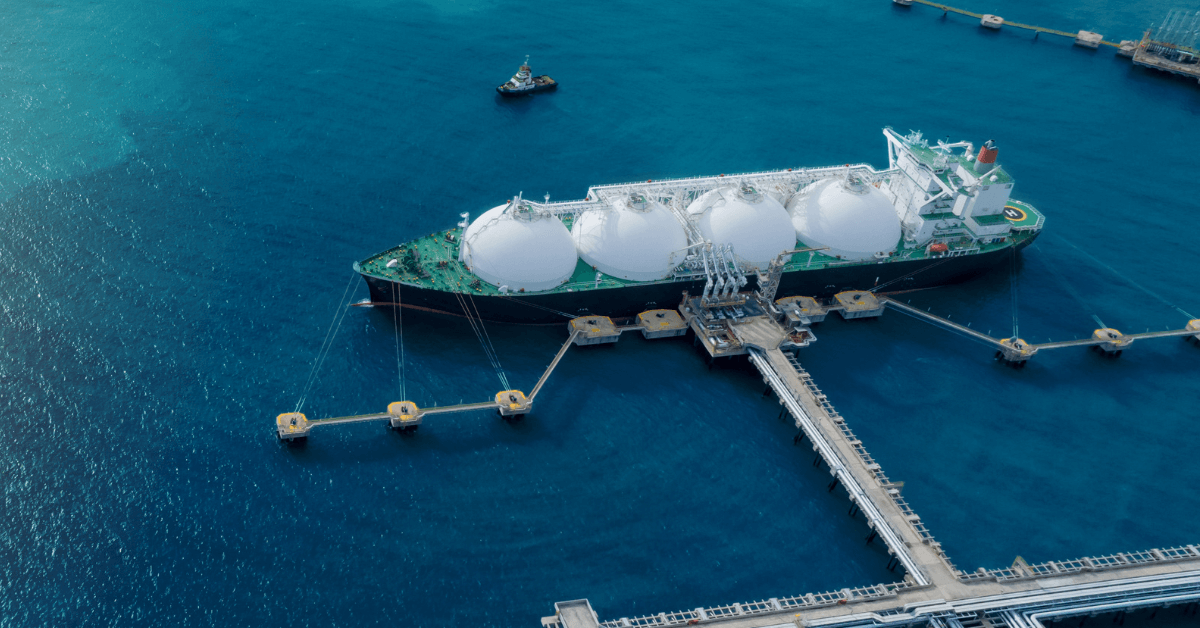

The new tariffs include a 15% duty on U.S. coal and liquefied natural gas (LNG) and a 10% tariff on crude oil, agricultural machinery, and large-engine cars imported from the U.S. These tariffs will take effect on February 10.

China’s State Administration for Market Regulation launched an anti-monopoly investigation into Google, just minutes after Trump’s tariffs went into effect at 0501 GMT on February 4.

Though Google’s search engine is already blocked in China, the company works with local advertisers and smartphone manufacturers.

Export Controls on Critical Minerals: China restricted exports of tungsten, tellurium, bismuth, molybdenum, and indium, all of which are crucial for electronics, military equipment, and solar panels. This follows previous controls on gallium and germanium.

Unreliable Entities List: China added PVH Group (owner of Klein and Tommy Hilfiger) and biotech company Illumina to this list, restricting their business activities in China. The government accused them of disrupting business with Chinese firms and discriminating against them. PVH has already been under investigation since September for alleged boycotting of Xinjiang cotton.

Impact on Tesla: China’s new 10% tariff on electric trucks could affect Tesla’s Cybertruck, which the company has been promoting in China. China’s State Council Tariff Commission criticised Trump’s tariffs, calling them a violation of WTO rules and harmful to US-China trade relations.

China filed a request for WTO consultations, triggering a 60-day resolution period, after which the case could go before a three-judge panel. However, the WTO’s dispute-resolution process has been weakened as the U.S. has blocked judge appointments in recent years.

Impact on U.S. Exports

The US is the world’s largest LNG exporter, but only 2.3% of its LNG exports went to China in 2023.

The U.S. exported less than 110,000 vehicles to China last year. However, the tariffs could impact GM’s Chevrolet Tahoe and GMC Yukon and Ford’s Mustang and F-150 Raptor pickup.

The U.S. supplies only 1.7% of China’s crude oil imports (worth $6 billion last year).

The stock market and oil prices rose after Trump’s team revealed that he plans to talk with Chinese President Xi Jinping soon. White House Press Secretary Karoline Leavitt said the call would happen “very soon.”

Trump recently paused tariffs on Mexico and Canada for 30 days after they agreed to strengthen border security and anti-drug trafficking measures. He hinted at potential tariffs on the European Union next but gave no timeline.

Experts believe China is better prepared this time than in the 2018 trade war. Gary Ng, a senior economist at Natixis, said China is strategically targeting sectors while minimising risks to its own economy.

John Gong, a professor in Beijing, called China’s response measured, adding that Beijing likely hopes for negotiations similar to those with Mexico and Canada.

Economic analysts warn that further escalation would lead to: lower global GDP growth, higher U.S. inflation, a stronger U.S. dollar, and increased U.S. interest rates.

China seems to be putting economic pressure on U.S. companies to influence Trump’s decisions. George Chen, from The Asia Group, said that by adding U.S. companies to the Unreliable Entities List, China is sending a message that it wants American businesses to push back against Trump’s tariffs.

References: CNN, AP News

Source: Maritime Shipping News