TUI Cruises Take Delivery Of Its First LNG Powered Cruise Ship From Fincantieri

February 8, 2025

UN To Review Seafarer Work Hours As Study Reveals Alarming 74% Overwork

February 8, 2025

South Korea secured the highest number of global shipbuilding orders in January, surpassing China, according to Clarkson Research, a British firm specialising in shipbuilding and shipping market analysis.

The data reveals that South Korean shipyards clinched 900,000 compensated gross tons (CGT) for 13 vessels, accounting for 62% of global ship orders.

On the other hand, China managed only 270,000 CGT for 21 ships, accounting for only 19% of the global orders.

Despite China having more ships, its focus on smaller, low-value vessels kept its CGT lower than South Korea, which specialises in large, high-value ships.

The global shipbuilding industry witnessed a sharp 74% decline in new orders, with total orders dropping to 1.46 million CGT compared to the same period last year.

However, South Korea saw a dramatic rise in its market share because of its focus on LNG-powered and advanced ships.

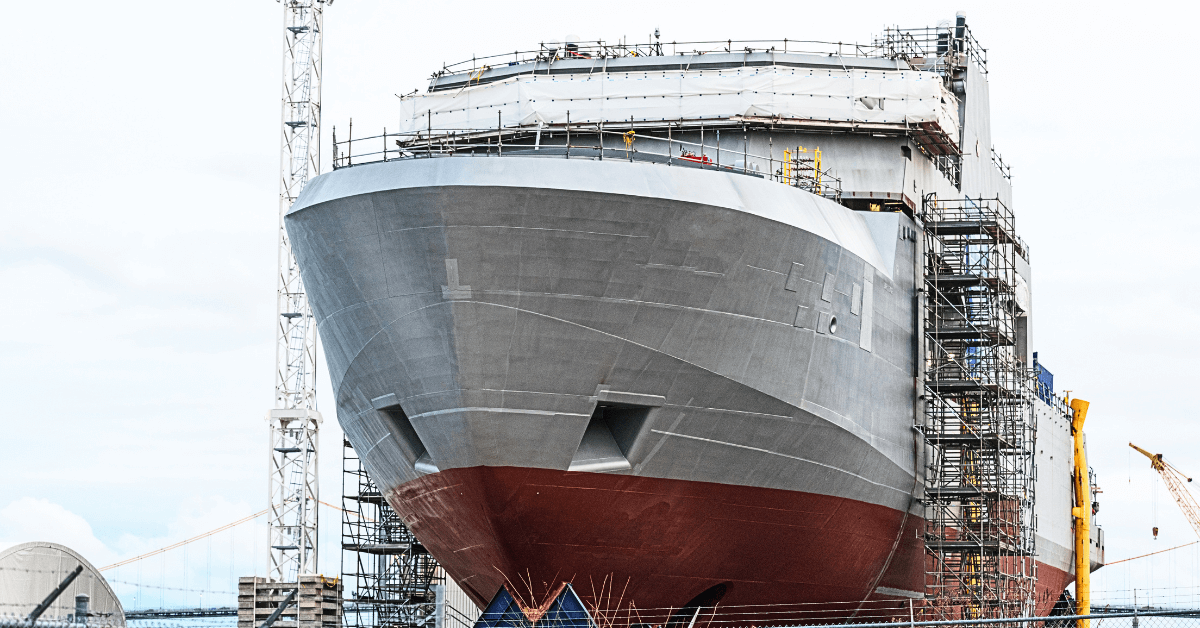

A key factor behind South Korea’s success was HD Korea Shipbuilding & Offshore Engineering’s contract to build 12 LNG dual-fuel container ships worth 3.716 trillion won for a European shipping company.

Additionally, Samsung Heavy Industries won a contract for one LNG carrier valued at 379.6 billion won from an Oceania-based shipping company.

South Korea’s shipbuilding performance in January has greatly improved from December, with just 130,000 CGT in December, marking up only 6% of global orders.

At that time, China dominated with 1.93 million CGT or 82% of global orders. However, China’s performance dropped sharply in January, with orders plunging 85% compared to December.

Although South Korea led in new orders in January, China still holds the largest backlog of shipbuilding orders. As of the end of January, China had 91.51 million CGT, making up 58% of the global total of 156.79 million CGT.

South Korea ranked second with 37.02 million CGT (24%).

The Clarkson Newbuilding Price Index, which tracks changes in ship prices, stood at 189.38 points in January, marking a 5% increase from the same period last year and a 49% jump compared to 2021.

References: YNA, KoreaTimes

Source: Maritime Shipping News