Singapore’s PIL Takes Delivery of First 8,200 TEU LNG Dual-Fuel Container Ship

May 13, 2025

MOL-Operated Car Carrier ‘ORCA ACE’ Receives 2024 Best Quality Ship Award

May 13, 2025

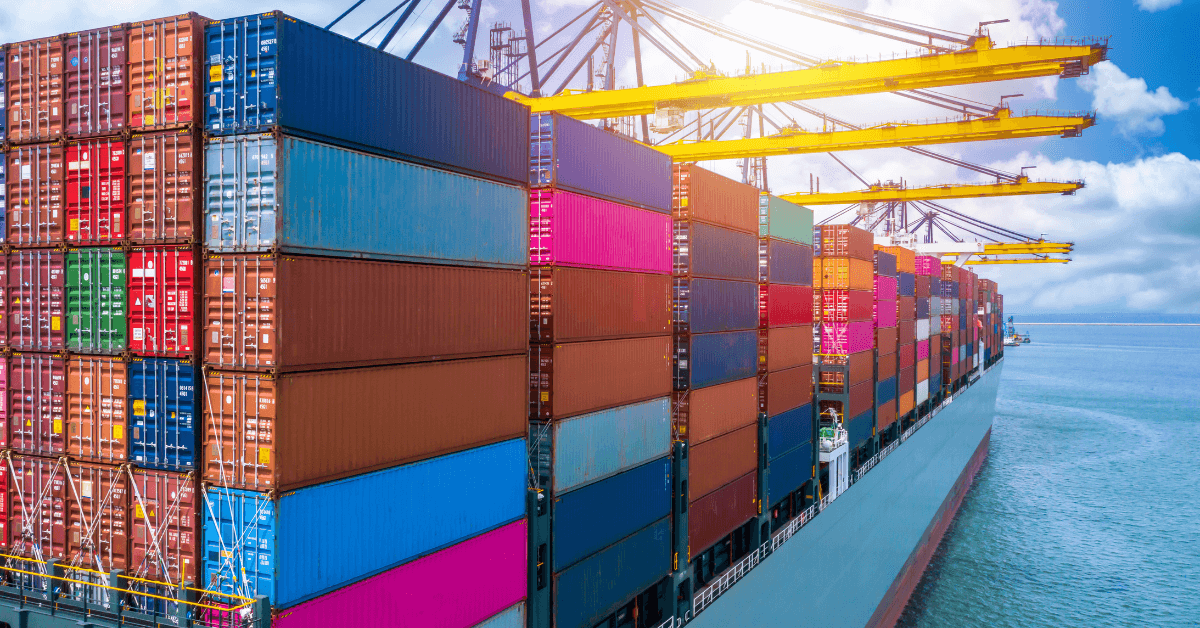

The United States and China have agreed to reduce the high tariffs they had placed on each other’s goods, giving the global economy a much-needed boost.

The announcement came on Monday after intense weekend talks in Geneva, Switzerland. As part of the deal, both countries will roll back their trade tariffs for 90 days.

The US will lower its tariffs on Chinese products from 145% to 30%. In return, China will cut its tariffs on US goods from 125% to 10%. These changes will come into effect on May 14.

However, the US will still keep a 20% tariff on Chinese goods linked to fentanyl, due to ongoing concerns about the opioid crisis.

In a joint statement, both countries said they aim to build a trade relationship that is “sustainable, long-term, and good for both sides.”

The announcement had an immediate impact on global financial markets. In the US, futures for the Dow Jones and S&P 500 rose by more than 2%, and Nasdaq futures shot up over 3.5%. Asian markets also responded positively, Hong Kong’s Hang Seng Index climbed by 3%.

Meanwhile, the US dollar strengthened and gold prices fell, showing that investors were feeling more confident. Along with reducing tariffs, China has agreed to stop several other actions it had taken against the US, including:

- Lifting export restrictions on rare-earth minerals, which are important for many industries.

- Removing American companies from its “unreliable entity” and “export control” lists.

- Ending an anti-monopoly investigation into the US chemical company DuPont.

The trade war has taken a toll on both countries. The US economy recently shrank for the first time since early 2022, and China’s exports to the US dropped sharply in April. China’s factories also saw their biggest slowdown in over a year.

Craig Singleton, an expert at the Foundation for Defense of Democracies, said both countries were “boxed in” by the economic pressure. “For Trump, markets are important, and this deal gives him a win without losing leverage,” he said.

US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer said that both countries will keep negotiating through a new system that may hold future meetings in the US, China, or a neutral location. These talks will focus on solving deeper issues that the current deal doesn’t cover.

Bessent also said that neither country wants to completely cut economic ties and that the earlier high tariffs were almost like an economic blockade.

The tariff rollback is expected to quickly boost trade. Lars Jensen, CEO of Vespucci Maritime, said he expects a sharp increase in shipments from China to the US as importers move goods that were previously on hold. This could lead to congestion at US ports by June or July, just before the holiday season.

Jay Foreman, CEO of toy company Basic Fun, said the tariff cuts help, but aren’t enough. “It’s like they gave us a rotten egg sandwich and now expect us to be happy with spoiled milk,” he said. He still expects toy prices to rise by 10–15% later this year.

While the deal has calmed tensions for now, experts warn that it’s only a temporary fix. Harvard economist Dani Rodrik called the situation “chaos for nothing,” saying the US didn’t gain much from the entire trade fight.

Eswar Prasad from Cornell University agreed, saying that although this is a positive step, the remaining high tariffs will still impact trade and investment.

The next few weeks will show whether this pause leads to a bigger, long-term solution, or if the US and China go back to clashing again.

Reference: CNN, AP News

Source: Maritime Shipping News