Towline Connected To Burning Ship Carrying Hazardous Cargo Near Kerala

June 12, 2025

UK Warns Ships Of Imminent Military Threat In Gulf Waters Amid Rising Tensions

June 12, 2025

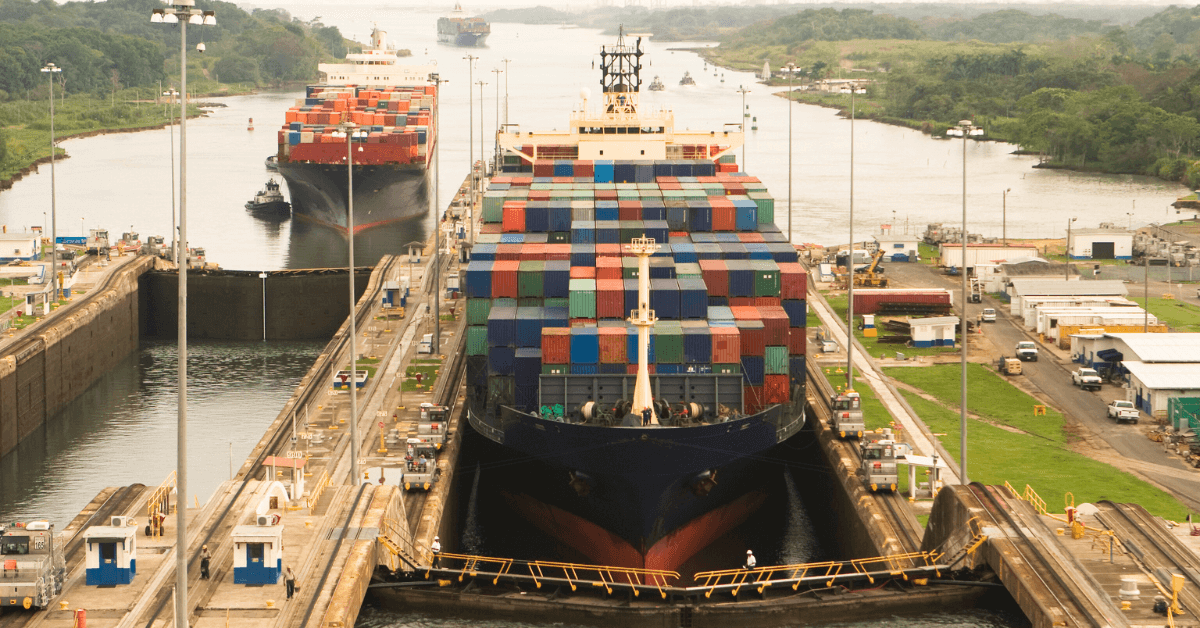

Container ship traffic through the Panama Canal has reached record-breaking levels in the first five months of 2025, with 1,200 vessel transits recorded in each direction, according to data from Alphaliner.

This figure marks a 4.1% rise compared to the previous record set in 2022 during the same period, and a 10.2% increase compared to the numbers from early 2024.

The increase in ship traffic is mostly because of Neo Sub-Panamax vessels, which can carry between 7,500 and 10,000 containers. Since January 2025, these ships have made up more than 25% of all container ship movements through the canal. Their number has gone up by 30.2% compared to the same time last year, showing that more shipping companies are using this size of vessel.

In 2023, the Panama Canal faced a tough time due to severe drought, which caused big delays. By August, 154 ships were stuck waiting, with some delayed up to 21 days. In response, the Panama Canal Authority (ACP) introduced strict water conservation measures, cutting down the number of daily transits and giving priority to larger vessels to make better use of limited water resources.

These changes had a positive financial impact. By November 2024, the ACP reported earnings of $400–450 million for the fourth quarter alone. This was achieved through a fully booked transit system that allowed larger ships carrying more containers to pass through, reducing the total number of transits while maintaining volume.

In 2025, the situation improved as water levels at Gatun and Alajuela Lakes increased. This allowed the canal to return to almost normal operations and handle more ships to keep up with global trade needs.

While the Panama Canal is seeing a strong recovery, the Suez Canal is experiencing a drop in traffic. In 2025, fewer container ships larger than 4,000 TEUs are using the Suez route. In May, less than 100 Sub-Panamax ships crossed the canal, its lowest since July 2024. This shows that shipping companies may be avoiding the Suez Canal due to political or logistical reasons.

At the same time, U.S. President Donald Trump stirred debate by saying the U.S. should consider “taking back” the Panama Canal, expressing concerns about China’s growing influence. His statement came as MSC and investment firm BlackRock are working on a $19 billion deal to buy Panama’s Balboa and Cristobal ports from Hong Kong-based CK Hutchison. This deal is part of a larger $23 billion plan to buy 45 ports worldwide and is under review. China has criticised the move, calling it a possible antitrust issue.

The Panama Canal Authority (ACP), which was created in 1997, has managed the canal since its handover from the U.S. in 1999. The agency oversees all operations including lock maintenance, water level management, and scheduling of ship transits. The ACP is also a major revenue generator for Panama. By 2025, its annual income is projected to exceed $6 billion.

References: indiashippingnews, portnews

Source: Maritime Shipping News