Vane Brothers & Shell Deliver First Biofuel To Cruise Ship At Manhattan Terminal

June 17, 2025

Video Shows Massive Fire Erupting From Oil Tankers After Collision

June 18, 2025

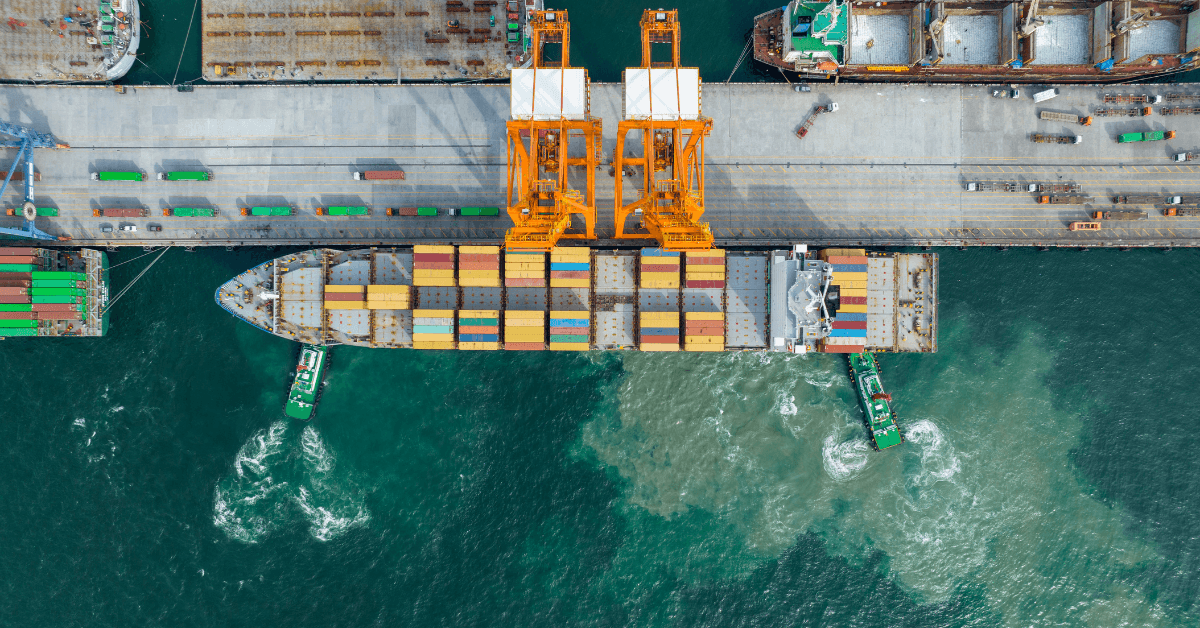

The ongoing conflict between Iran and Israel has led to a sharp rise in war risk insurance premiums for vessels heading to Israeli ports, nearly tripling in just a week.

According to industry sources, the insurance cost for seven-day voyages to Israel has risen from around 0.2% of a vessel’s value to as much as 1.0%. Although these rates are below the 2% peak reached during the November 2023 Hamas-Israel war, they are still adding tens of thousands of dollars in extra costs per voyage.

A senior marine insurance expert from a global brokerage said that ship calls to Israeli ports are now evaluated individually, depending on factors like cargo, location, and ship ownership. Some premiums have reached 1% even for short port visits.

The rising insurance rates come amid increased security risks in Israel’s maritime sector. On June 16, Israel’s largest oil refinery in Haifa, operated by the Bazan Group, was forced to halt operations after its power station was hit in an Iranian strike. Despite the attack, Haifa port terminals are still operational, according to a port management source.

However, around 30 ships, including several cargo vessels, were seen anchored in Haifa Bay on Tuesday, according to MarineTraffic data. This is a sign of growing hesitation among ship operators to dock in the area.

For essential imports, Israel relies heavily on its key ports, Haifa in the north, Ashdod in the south, and Eilat on the Red Sea. But with growing threats and regional tensions, shipping companies are becoming more cautious about visiting these ports.

The situation is getting more complicated as Iran-backed Houthi rebels in Yemen say they will keep attacking ships linked to Israel. In March, they declared a “maritime blockade” on Haifa port in response to Israel’s actions in Gaza, even though they had paused attacks on U.S. and UK ships in the Red Sea.

India is closely monitoring the situation, worried about its impact on trade and energy. Officials from the Commerce and Industry Ministry will meet exporters and shipping companies this week to understand the possible effects.

Most of India’s trade routes don’t go through the main conflict zone, but rising freight and insurance costs could still affect exporters significantly. The Global Trade Research Initiative (GTRI) says around 30% of India’s shipments to Europe, North Africa, and the U.S. pass through the Red Sea. Renewed instability in the region could disrupt these routes again.

One of the main concerns for India is the Strait of Hormuz-a narrow, strategic waterway that handles 20–30% of global oil trade. India relies on the Strait of Hormuz for two-thirds of its crude oil and half of its LNG imports, a route now under threat as Iran warns of closure.

Ajay Srivastava, founder of GTRI, warned that any escalation or complete closure of the strait could lead to a surge in global oil prices, increased shipping and insurance costs, and rising economic pressure on India.

Although India stopped buying oil from Iran in 2019 due to U.S. sanctions, any global supply disruption could still affect the country. Goldman Sachs recently said that if the situation worsens, Iran’s oil exports could drop by up to 1.75 million barrels per day for six months. This could send Brent crude prices above $90 per barrel before settling.

India’s Directorate General of Shipping has already issued a security alert for all Indian ships and seafarers operating in Iranian waters or crossing the Strait of Hormuz. Seafarers have been advised to stay alert, avoid unnecessary movements, and strictly follow safety rules.

Reference: Reuters

Source: Maritime Shipping News