Seafarers Must Not Be Scapegoated In Criminal Cases Without Evidence, Says InterManager

June 24, 2025

Video: Chinese Ship Veers Off Course In Suez Canal, Scrapes Dock After Steering Failure

June 24, 2025

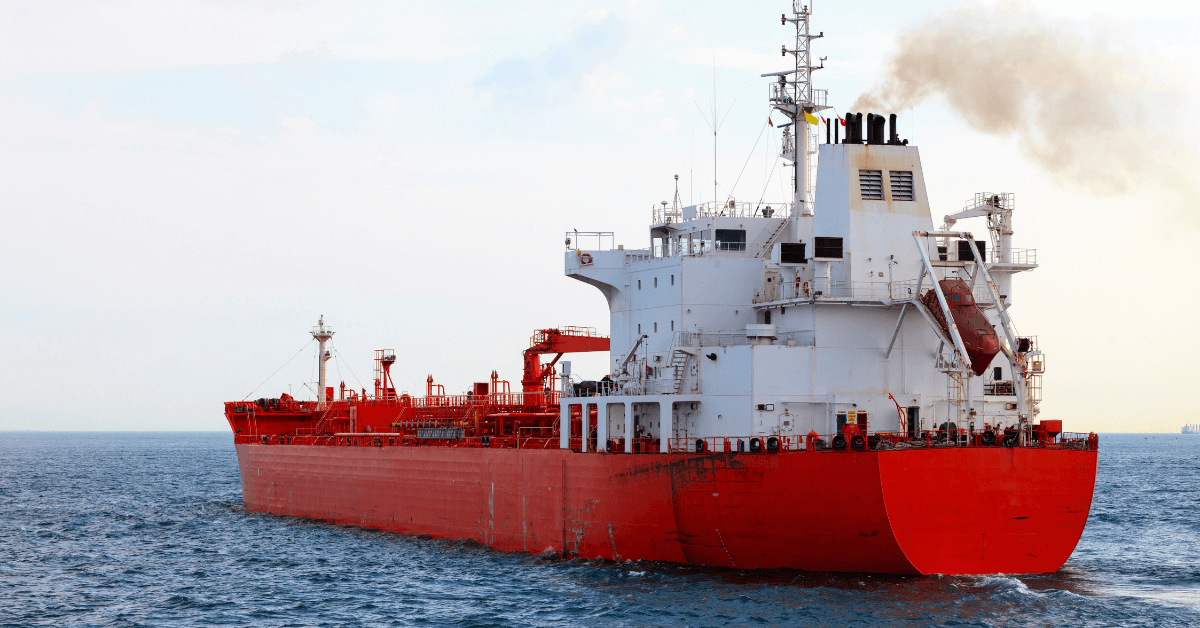

War risk insurance costs for ships sailing through the Middle East and Gulf region have doubled within a week. Insurance sources shared this update on Monday, pointing to the growing risk in the region, especially around the crucial Strait of Hormuz.

According to those familiar with the matter, war risk premiums for vessels heading to the Gulf have increased to about 0.5% of a ship’s value, up from the previous range of 0.2% to 0.3%. This means shipping companies now face tens of thousands of dollars in extra daily costs, especially during a seven-day voyage, depending on the vessel’s value.

While insurance underwriters usually set rates individually for each vessel and voyage, industry sources told Reuters and The Insurer that 0.5% was the average market rate on Monday. A senior marine insurance broker at McGill and Partners said prices are still changing and not yet stable.

This spike in insurance costs came after Iran launched a missile at a U.S. military base in Qatar on Monday. The attack was in response to American airstrikes over the weekend that targeted Iranian nuclear facilities. The situation has raised concerns that Iran could block the Strait of Hormuz.

Oil analysts have started predicting a possible surge in oil prices, with crude potentially climbing to $100 per barrel. In just seven days, supertanker rates have more than doubled; these ships typically hold around 2 million barrels of crude. Recent freight data shows that daily rates have now crossed $60,000.

For several months, war risk premiums for ships operating in the Gulf had been steady at around 0.3%. In comparison, in early 2024, rates in the Red Sea spiked to as high as 1% after the Iran-backed Houthi group attacked commercial ships, claiming they were acting in solidarity with Palestinians amid the Israel-Gaza conflict.

Similarly, insurance costs for ships heading to Israeli ports have sharply risen in recent days, with some quotes reaching up to 1%. Despite the rising tensions, London’s marine insurance market decided on June 18 not to expand the list of high-risk areas in the Gulf.

A representative of the Joint War Committee-a body that includes members of the Lloyd’s Market Association and London-based insurance companies, explained that most ships traveling through the Middle East already have to notify underwriters about their voyages. This process allows insurers to assess each case individually, so the listed areas were left unchanged.

Reference: Reuters

Source: Maritime Shipping News