Indian Navy Gets Its First Indigenous Diving Support Vessel, INS Nistar

July 14, 2025

Singapore Ranked World’s Top Maritime Hub For 12th Year In A Row

July 14, 2025

U.S. seaport operators are urging the government to give them more time before implementing high tariffs on large ship-to-shore cranes built in China. They expect President Donald Trump’s administration to move forward with plans that would effectively block the use of this essential cargo-handling equipment.

Earlier this year, the United States Trade Representative (USTR) proposed tariffs of up to 100% on cranes made in China. This came in response to China gaining control over the global market for these cranes as part of its efforts to lead both commercial and military activities at sea.

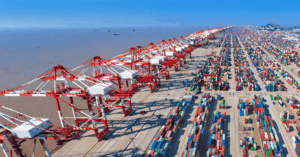

Chinese state-owned company Shanghai Zhenhua Heavy Industries (ZPMC) currently dominates this sector. It has supplied around 80% of the ship-to-shore cranes used in the U.S. More than 200 of these cranes are already in operation at nearly two dozen U.S. ports, including Houston, Los Angeles, and New York. Each crane costs between $10 million and $20 million.

Officials from the Trump administration said during meetings that they intend to stop any further purchases of Chinese-made cranes. Carl Bentzel, president of the National Association of Waterfront Employers (NAWE), said that the planned tariffs could serve as a complete ban on using such equipment from China. He added that he believes the 100% tariff rate is just the starting point.

Companies like Konecranes from Finland, Mitsui E&S from Japan, and Liebherr, which is based in Switzerland, have been promoted as alternatives.

In 2024, President Joe Biden had already imposed a 25% tariff on Chinese cranes. This came after U.S. security agencies, including the Cybersecurity and Infrastructure Security Agency (CISA), the Federal Bureau of Investigation (FBI), and the National Security Agency (NSA), raised concerns that China was trying to place cyber vulnerabilities inside important American infrastructure like port equipment.

Officials also warned that the modems, software, and other tech inside these cranes could be used for spying or even shutting down port operations during a crisis.

Despite these warnings, many port operators kept buying cheaper Chinese cranes. A research fellow from the Council on Foreign Relations, who previously worked at the National Security Council under Biden, said that the industry’s hesitation is focused on short-term savings and fails to consider the long-term risks of doing nothing.

In May, both U.S. port operators and representatives of ZPMC wrote to the USTR arguing that the security risks tied to the cranes were being exaggerated. They also warned that the sudden tariff could cost the industry billions of dollars and slow down necessary upgrades to stay competitive globally.

Now, NAWE and other industry groups are trying to reduce the impact of the expected tariffs. They are asking the government to exempt cranes that have already been ordered and to allow a transition period before the new tariffs fully apply.

Reference: Reuters

Source: Maritime Shipping News